How I Mastered My SPA Expenses with Smarter Asset Allocation

Ever feel like your wellness budget drains your wallet without lasting value? I did—until I treated my SPA spending like an investment, not just an expense. By rethinking how I allocate assets, I turned luxury self-care into a sustainable financial habit. It’s not about cutting back; it’s about planning smarter. Here’s how balancing health and wealth changed everything.

The Hidden Cost of Ignoring Wellness in Your Financial Plan

Many people treat SPA visits as indulgences—luxuries tucked into the corners of their monthly budgets, often paid for with leftover cash or credit card balances. But when wellness spending is unplanned, it can quietly erode financial progress. The cost of skipping structured budgeting for self-care isn’t just monetary; it affects long-term financial discipline and emotional well-being. When SPA services are viewed as occasional treats rather than consistent needs, they become reactive purchases made during times of stress, fatigue, or emotional imbalance. This pattern leads to erratic spending that disrupts savings goals, inflates credit card balances, and fuels cycles of guilt and overspending.

Consider a common scenario: a woman in her mid-40s, managing household responsibilities and a part-time career, schedules a massage after a particularly overwhelming week. She hasn’t budgeted for it, but the $120 feels justified—until three more unplanned visits follow in the next two months. By the end of the quarter, she’s spent nearly $500 on wellness services she didn’t plan for, money that could have gone toward a family vacation or an emergency fund. The real cost isn’t just the dollar amount—it’s the lost opportunity to align spending with values and long-term goals. When wellness is treated as an afterthought, it becomes a financial leak rather than a strategic investment.

What’s often overlooked is the connection between physical wellness and financial resilience. Chronic stress, poor sleep, and untreated muscle tension can lead to increased healthcare costs over time—missed workdays, prescription medications, or even long-term therapy. In this context, preventive self-care like regular massages or mindfulness sessions isn’t frivolous; it’s a form of risk mitigation. By integrating wellness into a comprehensive financial plan, individuals can reduce the likelihood of future medical expenses and maintain higher productivity in both personal and professional roles. The key is shifting perspective: SPA spending should not be seen as a luxury tax, but as a proactive component of a healthy financial ecosystem.

Ignoring this link creates a false dichotomy between being financially responsible and being personally cared for. Many women in the 30–55 age range face pressure to prioritize family and household needs over their own well-being. Yet, consistently sacrificing self-care can lead to burnout, which carries its own financial consequences. A 2022 study by the American Psychological Association found that chronic stress contributes to higher rates of absenteeism and reduced work performance, with indirect economic costs estimated in the billions annually. While the study doesn’t isolate SPA use, it underscores the broader principle: investing in mental and physical health yields measurable returns in energy, focus, and overall life satisfaction. When framed this way, wellness spending isn’t a distraction from wealth building—it’s an essential part of it.

Why Asset Allocation Isn’t Just for Stocks and Bonds

Asset allocation is a cornerstone of investment strategy, typically referring to how investors distribute funds across different classes—stocks, bonds, real estate, cash—to balance risk and return. But the principle extends far beyond the stock market. At its core, asset allocation is about intentional distribution of limited resources to achieve long-term stability and growth. When applied to personal finance, this concept can include not just money, but time, energy, and lifestyle priorities. Just as a well-diversified portfolio reduces volatility, a balanced allocation of financial resources across essential life categories—housing, education, healthcare, and yes, wellness—can create greater overall resilience.

For many, the idea of allocating assets to SPA services feels uncomfortable, even indulgent. But consider this: people routinely budget for car maintenance, home repairs, and insurance premiums—expenses that preserve value or prevent larger losses. Why should personal health be treated differently? Regular massages can prevent chronic pain; facials and skin treatments can delay more expensive dermatological interventions; meditation retreats can improve emotional regulation and decision-making. These are not mere luxuries—they are maintenance routines for the most important asset anyone has: themselves.

By treating SPA spending as a recurring financial commitment, similar to health insurance or retirement contributions, individuals can integrate it into their budgets without guilt or anxiety. This shift in mindset transforms the conversation from “Can I afford this?” to “How can I plan for this?” It allows for proactive decision-making rather than reactive spending. For example, someone might decide to allocate 3% of their discretionary income to wellness services, adjusting other non-essential spending to accommodate it. This isn’t about spending more—it’s about spending with intention, ensuring that self-care is neither neglected nor overindulged.

The beauty of applying asset allocation principles to lifestyle spending is that it introduces structure without rigidity. Just as an investor rebalances their portfolio annually, a person can review their wellness spending quarterly, adjusting based on income changes, health needs, or life events. This approach fosters financial awareness and emotional balance, reducing the all-or-nothing thinking that often leads to overspending followed by austerity. It also encourages prioritization: if a spa day costs $200, is it delivering proportional value compared to a weekly yoga class or a monthly therapist visit? By evaluating these choices through an allocation lens, individuals gain clarity and control.

Mapping Your Real SPA Spending Patterns

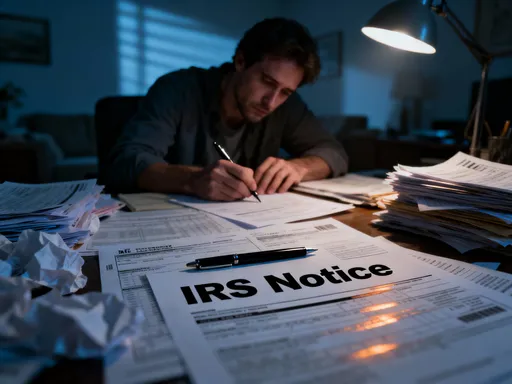

Before any financial strategy can be effective, there must be a clear understanding of current behavior. Most people significantly underestimate how much they spend on wellness services. A quick mental tally might suggest occasional visits—once every few months—but when tracked over a year, the total often surprises. The first step in mastering SPA expenses is creating an accurate map of actual spending. This involves collecting receipts, reviewing bank statements, and categorizing every wellness-related transaction: massages, facials, manicures, aromatherapy sessions, wellness retreats, and even online subscriptions to meditation apps or virtual yoga classes.

One practical method is to divide these expenses into three categories: frequency, cost, and perceived value. Frequency refers to how often the service is used—daily, weekly, monthly, or annually. Cost is straightforward: the dollar amount paid, including tips and taxes. Perceived value is more subjective but equally important: did the experience deliver lasting benefits in terms of relaxation, pain relief, or emotional clarity? A $180 massage that provides two weeks of improved sleep may offer higher value than a $90 session with minimal impact. Tracking all three elements over six to twelve months reveals patterns that inform smarter decisions.

Take the example of a 48-year-old woman who believed she spent “about $1,000 a year” on spa services. After reviewing her credit card statements, she discovered she had actually spent $2,347—nearly two and a half times her estimate. The largest portion came from last-minute bookings during stressful periods, often paid with credit cards and followed by weeks of regret. She also realized that while she visited a high-end spa quarterly, her most consistent source of relief came from a $25 infrared sauna session she attended weekly but rarely counted as “real” self-care. This discrepancy highlighted a misalignment between perceived importance and actual impact.

Another common pattern is the bundling of SPA spending with travel or social events. Weekend getaways often include spa packages, and birthday celebrations may feature group wellness experiences. While enjoyable, these costs are frequently absorbed into broader trip budgets, making them invisible as standalone expenses. By isolating these amounts, individuals gain a more accurate picture of their total wellness investment. For instance, a $300 weekend retreat that includes a $120 massage and a $75 facial should be partially categorized under wellness, not just leisure. This level of detail enables more informed trade-offs: perhaps reducing one luxury trip per year could fund six months of regular preventive care.

Building a Tiered Funding Strategy for Wellness

Once spending patterns are clear, the next step is to design a sustainable funding model. A tiered approach allows for flexibility while maintaining discipline. This strategy divides wellness spending into three levels: essential, preventive, and premium. Each tier serves a distinct purpose and is funded differently, ensuring that core needs are met before allocating to higher-cost experiences.

The essential tier includes services that address immediate physical or emotional needs—such as a massage to relieve chronic back pain or a counseling session during a difficult life transition. These are non-negotiable investments in well-being and should be prioritized in the budget. Funding for this tier can come from the primary household income, treated similarly to medical expenses. The goal is consistency: scheduling these services regularly, not waiting until a crisis arises.

The preventive tier focuses on maintaining health and avoiding future problems. This includes monthly facials to support skin health, weekly yoga classes to improve flexibility, or quarterly chiropractic adjustments. These services may not address acute issues, but they contribute to long-term wellness. To fund this tier, a sinking fund approach works well. A sinking fund is a dedicated savings account where small amounts are set aside monthly for a future expense. For example, saving $40 per month creates a $480 annual fund for preventive care, allowing for planned, guilt-free spending without relying on credit.

The premium tier covers aspirational experiences—weekend retreats, luxury spa packages, or specialized treatments like cryotherapy or IV vitamin infusions. These are not essential but can provide meaningful rejuvenation when budgeted for responsibly. Funding for this tier should come from discretionary income or windfalls—tax refunds, bonuses, or proceeds from selling unused items. By separating premium spending from essential and preventive categories, individuals avoid overspending during tight months while still enjoying occasional luxuries.

This tiered model promotes financial balance by aligning spending with values. It also reduces decision fatigue: when a promotional email arrives for a $200 massage package, the question isn’t “Can I afford it?” but “Which tier does this belong to, and do I have funds allocated?” This simple shift transforms spending from impulsive to intentional, reinforcing a sense of control and empowerment.

Balancing Risk: When Self-Care Becomes Financial Stress

Just as over-diversification can dilute investment returns, over-investing in wellness can strain personal finances. The goal is balance—not deprivation, but proportionality. Risk in personal finance isn’t only about market volatility; it also includes behavioral risks like emotional spending, lifestyle inflation, and under-saving for emergencies. When SPA spending grows unchecked, it can crowd out more critical financial goals, such as building an emergency fund, paying down high-interest debt, or saving for children’s education.

Consider a scenario where monthly spa expenses exceed $300, consuming 15% of disposable income. While the individual may feel refreshed in the short term, this level of spending could delay retirement by several years if redirected toward compound investments. Conversely, spending nothing on self-care may lead to burnout, increased healthcare costs, and reduced quality of life. The challenge is finding the optimal point where wellness spending enhances, rather than undermines, financial health.

One way to assess this balance is through a cost-benefit analysis. Ask: what tangible improvements has this spending produced? Has it reduced doctor visits? Improved sleep quality? Enhanced work performance? If the answer is consistently no, it may be time to reallocate funds. Similarly, during periods of income reduction—such as job loss, reduced hours, or increased family expenses—it’s wise to temporarily scale back premium-tier spending while protecting essential and preventive care.

Another risk is the emotional dependency on luxury treatments as a coping mechanism. When spa visits become the primary way to manage stress, individuals may neglect lower-cost, sustainable alternatives like walking, journaling, or deep breathing exercises. This creates financial vulnerability: if funds run low, the emotional support system collapses. A resilient approach includes a mix of paid and free wellness practices, ensuring continuity even during tight budgets. By viewing SPA spending as one tool among many, rather than the only solution, individuals build greater financial and emotional stability.

Tools and Habits That Make It Stick

Sustainable financial change requires systems, not willpower. Budgeting apps like YNAB (You Need A Budget) or Mint can help track wellness spending in real time, categorizing each transaction and showing trends over months. Setting up a separate savings account labeled “Wellness Fund” creates psychological separation, making it easier to resist dipping into other budgets. Automated transfers—such as $50 moving to the wellness account on the first of every month—ensure consistent funding without constant decision-making.

Calendar-based reminders are another effective tool. Scheduling quarterly financial check-ins allows for review and adjustment of the wellness allocation. During these sessions, evaluate what’s working: Did the spending deliver value? Were there impulse purchases? Should the tiered budget be adjusted? This practice fosters accountability and long-term alignment with goals. Pairing these check-ins with a personal reflection—writing down how you’ve felt physically and emotionally over the past months—adds depth to the financial review.

Behavioral nudges also play a role. For example, setting a rule that any new wellness purchase must be pre-approved during a monthly planning session reduces impulse decisions. Or, requiring a 48-hour waiting period before booking a non-essential spa service allows time for reflection. These small habits compound over time, creating a culture of mindful spending. Over months, this system transforms from effortful discipline to automatic behavior, freeing mental energy for other priorities.

Support networks can reinforce these habits. Discussing financial goals with a trusted friend or partner—without judgment—creates accountability. Some women find it helpful to join online communities focused on intentional living or financial wellness, where members share strategies and encouragement. Knowing others are navigating similar challenges reduces isolation and strengthens commitment.

From Expense to Investment: Reframing Your Financial Mindset

The journey from reactive spending to strategic allocation is more than a financial upgrade—it’s a mindset transformation. When SPA expenses are planned, categorized, and aligned with personal values, they cease to be sources of guilt and become expressions of self-respect. This shift doesn’t require earning more or spending less; it requires thinking differently. Wealth is not merely the accumulation of money, but the quality of life it supports. A woman who budgets wisely for wellness isn’t being indulgent—she’s being strategic.

By applying asset allocation principles to self-care, individuals create a more resilient, balanced life. They protect their health, reduce future financial risks, and enhance daily well-being—all while maintaining control over their finances. This holistic approach recognizes that true prosperity includes peace of mind, physical comfort, and emotional stability. It’s not about choosing between being rich and being well; it’s about achieving both through intentional design.

As you review your own spending, consider this: what if every dollar spent on wellness was a vote for the kind of life you want to live? When framed this way, budgeting becomes an act of empowerment. You’re not restricting yourself—you’re investing in a future where health and wealth coexist. That’s not just smart money management. That’s financial wisdom in its most complete form.