How I Protected My Wallet While Funding My Kid’s Art Dreams

Paying for art classes felt like supporting a passion—until I nearly drained my savings. Like many parents, I wanted to nurture my child’s talent, but the costs piled up fast. I didn’t realize how risky it could be until I faced unexpected fees, dropped programs, and wasted payments. This is the real talk no one gives you: how to invest in art education without losing money or sleep. Behind every brushstroke, performance, or recital lies a financial reality most families aren’t prepared for. The good news is that with awareness, planning, and discipline, it’s possible to support your child’s artistic growth while protecting your household budget. This is not about cutting corners—it’s about making informed choices that last.

The Hidden Costs Behind the Canvas

Art education often begins with a simple tuition fee, but that number rarely tells the full story. Many parents are surprised to find that the real cost of nurturing artistic talent extends far beyond the monthly invoice. Supplies alone can add hundreds of dollars annually—from paint sets and canvases to specialized instruments, dancewear, or theater costumes. For example, a young violinist might need rosin, extra strings, a music stand, and a high-quality case, all before the first lesson begins. Dancers face recurring expenses like leotards, tights, shoes that wear out quickly, and seasonal recital costumes, which can cost over $100 each. These items are not luxuries; they are necessities for consistent participation.

Beyond materials, there are performance-related costs that emerge throughout the year. Many art programs require students to take part in exhibitions, recitals, or competitions, each with its own fee structure. Registration fees for a single art show can range from $25 to $75, while dance recitals often include production charges that cover lighting, choreography, and venue rentals. These are typically non-refundable, even if a child falls ill or withdraws. Additionally, private coaching or master classes may be suggested as optional upgrades, but they quickly become expected, adding hundreds more to the annual tally. Families who assume art training is low-cost compared to sports or academic tutoring often find themselves blindsided by this layered financial burden.

Another frequently overlooked expense is program continuity. Some schools charge renewal fees just to reserve a spot for the next term, even if the family hasn’t yet decided to continue. Others require long-term commitments with steep penalties for early withdrawal. Add in transportation costs for classes held off-site, travel for regional competitions, and professional photography for portfolios, and the numbers accumulate rapidly. A 2022 informal survey of urban parents in the U.S. found that families spent an average of $1,200 per year per child on extracurricular arts, with some exceeding $3,000 during peak development years. Understanding this full scope is the first step toward financial preparedness. Without it, even well-meaning support can lead to stress, debt, or the painful decision to discontinue a beloved activity.

Why Art Investments Feel Riskier Than They Should

One of the reasons art education feels financially uncertain is the lack of standardization. Unlike math tutoring, where progress can be measured by test scores, or sports, where improvement shows in speed or strength, artistic development is deeply subjective. A child’s growth in drawing, music, or acting may not be obvious week to week, and milestones are often intangible. This ambiguity makes it difficult to assess whether the money being spent is yielding value. Parents may continue investing simply because they fear that stopping could stifle their child’s potential, even when engagement or progress has plateaued.

Emotional spending plays a significant role in this dynamic. When a child expresses passion, parents naturally want to encourage it. The desire to be supportive can override budget considerations, especially when instructors or program leaders imply that “serious” students must commit to higher levels of training. Phrases like “She has real talent” or “He could go pro” are powerful motivators, but they can also create pressure to spend more than planned. These emotional triggers are not always manipulative—many educators genuinely believe in their students—but they do contribute to a culture where financial decisions are driven more by hope than by evidence.

Moreover, art programs rarely offer transparent metrics for success. There is no equivalent to a grade point average or a batting average to help parents evaluate return on investment. Without clear benchmarks, families rely on feedback from teachers, which may be encouraging but vague. This lack of accountability increases financial risk, as it becomes harder to distinguish between a program that is truly effective and one that simply excels at marketing. The long timeline of artistic mastery—often requiring years of consistent effort before any measurable outcome appears—further compounds the uncertainty. Parents are essentially making a long-term financial commitment without knowing whether the payoff will ever materialize. Recognizing these psychological and structural factors is essential to breaking the cycle of reactive spending and moving toward intentional investment.

Spotting Red Flags Before You Sign

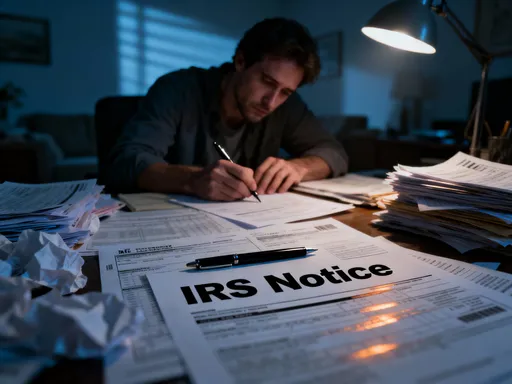

Not every art program is built on solid financial or educational foundations. Some operate with minimal oversight, unclear policies, or unrealistic promises. Before signing any agreement, parents must take time to evaluate the institution’s credibility and transparency. One of the first steps is researching the instructors. Are they credentialed in their field? Do they have verifiable experience, or are their qualifications listed in vague terms like “passionate artist” or “seasoned performer” without specifics? Reputable programs provide bios, performance histories, or teaching certifications that can be independently verified.

Equally important is reviewing the contract. Many families skip this step, assuming it’s just a formality. However, the fine print often contains critical information about refunds, withdrawals, and liability. Some programs state that all payments are non-refundable, even in cases of injury or relocation. Others charge administrative fees for missed classes or require automatic renewals unless canceled in writing weeks in advance. These clauses can trap families in ongoing payments for services they no longer use. A red flag should go up if the provider refuses to provide a written agreement or pressures you to sign on the spot during an open house or trial class.

Observing a trial class can reveal more than brochures ever could. Watch how the instructor engages students, whether class time is used effectively, and if the environment feels supportive rather than overly competitive. Pay attention to how questions from parents are handled. Are staff members responsive and informative, or dismissive and rushed? Also, talk to other parents if possible. Online reviews can help, but firsthand accounts from families with similar goals offer more reliable insights. If a program seems too good to be true—promising rapid advancement, scholarships, or professional opportunities—it’s wise to proceed with caution. Legitimate institutions focus on growth and learning, not on selling dreams. By doing due diligence upfront, families can avoid costly mistakes and ensure their investment aligns with both their child’s needs and their financial limits.

Building a Smart Payment Strategy

How you pay matters as much as how much you pay. Many art programs offer discounts for upfront, lump-sum payments, which can seem like a smart way to save. However, this approach increases financial risk. If the program closes, relocates, or fails to deliver as promised, recovering a large prepaid amount can be difficult or impossible. In contrast, spreading payments over time through monthly installments provides flexibility and protection. It allows families to pause or exit if issues arise, without losing a significant portion of their investment.

A more advanced strategy involves milestone-based payments. Some institutions allow families to pay in phases tied to specific events, such as the start of a term, a recital, or a portfolio review. This ensures that funds are released only as value is delivered. Another option is using third-party platforms that act as payment intermediaries, holding funds until services are confirmed. While not common in the arts sector, this model is used in some private tutoring and coaching arrangements and could be proposed as a safeguard in high-cost programs.

For added control, families can set up a dedicated education account—a separate savings or checking account used exclusively for art-related expenses. This makes it easier to track spending, set monthly limits, and avoid dipping into emergency funds. Automating transfers into this account at the start of each month helps build a cushion over time. Some parents treat it like a subscription: if the account doesn’t have enough to cover the next payment, it’s a signal to reassess. This method turns emotional spending into a structured, rule-based system. It also prepares families for seasonal spikes, such as recital fees in spring or supply purchases at the start of a new program. By aligning payment methods with financial safety, parents gain peace of mind and maintain long-term sustainability.

Diversifying Skills Without Breaking the Bank

Putting all your resources into one artistic discipline can be risky, especially when children’s interests evolve quickly. A child passionate about ballet at age eight may lose interest by twelve, leaving behind unused costumes, unused lessons, and financial regret. To reduce this risk, a portfolio approach to artistic development can be far more effective. Instead of going all-in on a single path, families can allocate smaller amounts across multiple low-cost or free opportunities, allowing the child to explore different forms of expression before committing deeply.

Community centers, public libraries, and local arts councils often offer affordable workshops in drawing, music, theater, or creative writing. These programs are usually short-term, making them ideal for testing interest without long-term financial exposure. Online platforms provide another valuable resource, with thousands of free or low-cost courses in everything from digital art to piano fundamentals. While they can’t replace in-person instruction, they offer accessible entry points and supplemental learning. School-based programs, though sometimes underfunded, can also serve as a foundation, especially when combined with selective private instruction.

This diversified model not only reduces financial risk but also enriches the child’s creative experience. A student who tries theater, ceramics, and guitar may discover unexpected talents or develop a broader artistic perspective. Even if they eventually focus on one area, the exposure to multiple disciplines enhances their overall skill set and adaptability. It also teaches them to value effort over immediate results, a crucial mindset for long-term success. By treating early artistic exploration like a discovery phase rather than a professional track, families can support growth without overextending their budgets. The goal is not to limit ambition, but to build it on a foundation of informed choice and financial balance.

When to Walk Away—And How to Do It Gracefully

There comes a time when continuing a program no longer makes sense—whether due to poor teaching quality, mismatched pacing, or financial strain. Yet many families persist because they’ve already spent so much. This is known as the sunk-cost fallacy: the belief that past investments must be honored, even when future costs outweigh future benefits. Resisting this trap is essential for both financial health and emotional well-being. Recognizing when to step back is not a failure; it’s a sign of responsible stewardship.

Warning signs include a lack of progress despite consistent effort, a child who dreads classes, or repeated billing issues. If feedback from instructors is vague or overly critical without constructive guidance, it may indicate a mismatch. Financial strain is another valid reason to reconsider. No dream should come at the cost of basic household stability. The key is to evaluate the situation objectively, focusing on current and future value rather than past payments.

Exiting gracefully involves clear communication and documentation. Start by reviewing the contract to understand your rights regarding refunds or credit transfers. Contact the program director in writing, stating your decision calmly and respectfully. If possible, request a partial refund, a credit for future services, or permission to transfer unused sessions to another student. Some institutions may offer flexibility, especially if you provide advance notice. If a formal exit isn’t possible, consider shifting to self-directed learning using free online resources, community events, or independent practice. This keeps the passion alive without the financial burden. Letting go of a program doesn’t mean letting go of the dream—it means making space for better, more sustainable options.

Long-Term Planning for Passion and Practicality

Supporting an artistic journey is not a short-term expense; it’s a long-game investment that requires foresight and discipline. Just as families plan for college or retirement, they can create a multi-year budget for artistic development. This begins with setting clear goals: Is the focus on personal enrichment, skill mastery, or professional preparation? Each path carries different financial implications. Enrichment may require only modest spending, while pre-professional training can demand significant resources, especially in later years.

Break the journey into phases. Early years should emphasize exploration and foundational skills, with spending kept low and flexible. As the child grows and commitment deepens, allocate more resources, but only after reassessing interest and progress. Anticipate peak-cost periods, such as audition seasons, competition entries, or college portfolio development, and begin saving for them years in advance. Treating these as predictable expenses, rather than surprises, reduces stress and prevents last-minute borrowing.

Align financial planning with educational milestones. For example, a student aiming for an arts-focused high school should have a structured training plan by age 12, with corresponding budget adjustments. Regular check-ins—every six to twelve months—allow families to recalibrate goals, adjust spending, and celebrate progress. Involve the child in these conversations to build financial awareness and ownership. When they understand the cost of their activities, they may become more committed and appreciative.

The ultimate goal is balance: nurturing passion without compromising long-term security. Art should enhance a child’s life, not endanger the family’s future. With thoughtful planning, transparent communication, and disciplined spending, it’s possible to support creativity responsibly. This isn’t about limiting dreams—it’s about building them on a foundation that lasts.

Supporting an artistic journey doesn’t mean sacrificing financial stability. With clearer expectations, smarter safeguards, and thoughtful planning, families can fund creativity responsibly. The goal isn’t to stop spending—it’s to spend with confidence, knowing every dollar supports growth, not guesswork. By understanding the full cost of art education, recognizing emotional triggers, and implementing practical financial strategies, parents can protect their wallets while empowering their children. Passion and prudence don’t have to be at odds. When aligned, they create a future where talent can thrive without compromise.