What Your Will Says About Your Money Moves

You’ve worked hard to build your life and assets—so why leave their future to chance? A will isn’t just about what happens when you’re gone; it’s a powerful financial tool that shapes how your wealth is managed, protected, and passed on. I learned this the hard way, after nearly losing control of everything due to a simple oversight. This is not just estate planning—it’s smart money management. Without a clear plan, even substantial savings and well-earned property can become sources of conflict, delay, and avoidable cost. A will gives you authority over your legacy, ensuring your intentions are honored and your loved ones are shielded from unnecessary hardship. It reflects discipline, foresight, and responsibility—qualities that define true financial wisdom.

The Hidden Financial Power of a Will

A will is often misunderstood as a document only for the elderly or the wealthy, but in reality, it is a foundational element of sound financial planning for anyone who owns property, has savings, or supports dependents. At its core, a will is a legal declaration that outlines how your assets should be distributed after your passing. However, its influence extends far beyond simple inheritance. It serves as a directive that prevents confusion, reduces family conflict, and maintains control over your financial legacy. Without a will, state intestacy laws take over, determining who inherits your property based on a one-size-fits-all formula that rarely aligns with personal wishes. This can result in unintended beneficiaries, exclusion of close family members, or even the sale of cherished assets to settle unclear claims.

More than just a list of who gets what, a will plays a critical role in debt management and estate settlement. When someone passes without a will, outstanding debts do not disappear—they must still be paid, often from the estate’s assets. Without clear instructions, this process becomes chaotic, with no prioritization of obligations or guidance on which accounts should be used. A properly structured will can designate specific funds or assets to cover debts, taxes, and final expenses, preserving the remaining inheritance for intended heirs. This level of control helps prevent liquidation of key assets, such as a family home or retirement account, simply because there was no plan in place.

Equally important is the will’s ability to minimize tax exposure. While a will itself does not eliminate estate taxes, it works in coordination with other strategies—such as gifting during life or establishing trusts—to reduce the taxable value of an estate. For example, by clearly allocating assets to spouses, children, or charitable organizations, a will can help take advantage of available tax exemptions and deductions. This proactive approach ensures that more of your hard-earned wealth stays within your family rather than being absorbed by legal and tax complications. In this way, a will is not merely a reactive document but a strategic instrument in long-term wealth preservation.

Perhaps most significantly, a will reinforces financial responsibility by forcing individuals to take stock of their current situation. The process of creating one requires a comprehensive review of assets, liabilities, and personal relationships—something many people avoid until a crisis occurs. By confronting these realities head-on, individuals gain clarity about their financial health and are better equipped to make informed decisions. This awareness often leads to additional planning steps, such as updating insurance policies, revising investment strategies, or initiating conversations about care preferences. In essence, writing a will is not just about preparing for death; it is about gaining control over your financial life today.

How a Will Fits Into Broader Wealth Planning

A will should never be viewed in isolation. Instead, it functions as the central piece of a broader financial puzzle that includes trusts, life insurance, retirement accounts, and powers of attorney. While beneficiary designations on retirement plans or insurance policies directly determine who receives those funds, they do not override the instructions in a will when it comes to non-designated assets. This distinction is crucial: if you own real estate, bank accounts without payable-on-death clauses, or personal property, those items typically pass through your will. Therefore, even if you’ve named beneficiaries elsewhere, failing to create a cohesive plan can lead to contradictions and legal disputes.

For instance, imagine a scenario where a woman names her sister as the beneficiary on her life insurance policy but leaves all her assets to her husband in her will. If she passes away, the husband receives everything outlined in the will, but the sister gets the insurance payout regardless. This may be intentional, but if the woman later remarried and forgot to update her policy, the outcome could defy her true intentions. Such oversights are common and highlight why a will must be integrated with other financial instruments. The goal is alignment—ensuring that every component of your financial life supports the same vision for your legacy.

Trusts are another key element that works hand-in-hand with a will. While a will goes into effect after death and must pass through probate, a trust can manage assets both during life and after. Revocable living trusts, in particular, allow individuals to transfer ownership of property into the trust while retaining control during their lifetime. Upon death, the trust distributes assets according to its terms, often avoiding probate entirely. A will can include a “pour-over” provision that directs any assets not already in the trust to be transferred into it upon death, acting as a safety net. This combination provides flexibility, privacy, and efficiency—advantages that a standalone will cannot offer.

Additionally, powers of attorney and advance healthcare directives complement a will by addressing decision-making during life, not just after death. A durable power of attorney authorizes someone to manage financial affairs if you become incapacitated, preventing court-appointed conservatorship and ensuring bills are paid, investments monitored, and assets protected. Similarly, a healthcare directive communicates medical preferences, reducing emotional strain on family members. Together, these documents form a complete financial and personal care strategy. When all pieces are aligned, they create a seamless system that protects your interests at every stage—whether you’re fully capable, temporarily incapacitated, or no longer here.

Avoiding Costly Legal and Tax Traps

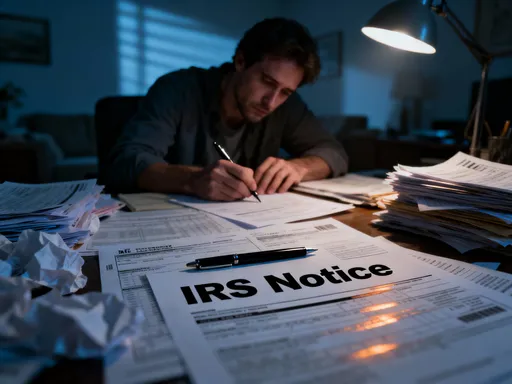

One of the most significant risks of dying without a will is the automatic activation of probate—a court-supervised process that oversees the distribution of assets when no valid will exists. Probate can be lengthy, sometimes lasting months or even years, depending on the complexity of the estate and local laws. During this time, assets are often frozen, making it difficult for surviving family members to access funds for living expenses, funeral costs, or mortgage payments. This financial strain can force families to take out high-interest loans or sell property at a loss, undermining the very wealth they are meant to inherit.

Probate is also a public process, meaning that estate details—including asset values, debts, and beneficiary names—become part of the public record. This lack of privacy can expose families to unwanted attention, including solicitations from marketers or even potential scams targeting vulnerable survivors. In contrast, a well-drafted will allows for a more streamlined probate process, especially when combined with tools like trusts or joint ownership with rights of survivorship. These mechanisms can bypass probate altogether, enabling faster, private, and less expensive transfers of wealth.

Tax implications are another area where poor planning can lead to substantial losses. While federal estate taxes only affect estates exceeding a high threshold—currently over $12 million for an individual—some states impose their own estate or inheritance taxes at much lower levels. Without a will, there is no opportunity to apply tax-saving strategies, such as charitable bequests, spousal deductions, or lifetime gifting. Even modest estates in high-tax states can face unexpected liabilities if no plan is in place. A will allows for intentional structuring—such as leaving certain assets to tax-exempt beneficiaries or timing distributions to minimize tax brackets—which can preserve thousands of dollars for heirs.

Legal disputes are perhaps the most emotionally and financially draining consequence of inadequate planning. When a person dies without a will, or with an outdated or ambiguous one, family members may disagree over who should receive what. Siblings may argue over sentimental items, former spouses may claim rights, or stepchildren may feel excluded. These conflicts often escalate into costly litigation, with legal fees eroding the estate’s value. A clear, legally sound will reduces ambiguity by explicitly naming beneficiaries, outlining conditions for distribution, and appointing a trusted executor. This transparency fosters trust and minimizes the chances of prolonged court battles, allowing families to focus on healing rather than fighting.

Protecting Your Family’s Financial Future

For parents, caregivers, and those supporting dependents, a will is one of the most compassionate financial decisions they can make. It allows individuals to formally appoint a guardian for minor children, ensuring they are raised by someone they trust rather than leaving the decision to a judge. This choice is not just emotional—it has direct financial implications. The appointed guardian will typically manage the child’s inheritance until they reach adulthood, so selecting someone responsible and financially literate is essential. A will can also establish a trust to hold assets for minors, with specific instructions on how and when funds should be used—for education, healthcare, or housing—providing structure and protection against mismanagement.

Similarly, individuals with dependents who have special needs must take extra care in planning. A standard inheritance could disqualify a beneficiary from receiving government assistance such as Medicaid or Supplemental Security Income (SSI), which have strict income and asset limits. To prevent this, a will can incorporate a special needs trust, allowing funds to be used for additional care, therapies, or quality-of-life improvements without jeopardizing eligibility for public benefits. This level of planning requires coordination with legal and financial professionals, but the payoff is immense: peace of mind knowing that a loved one will continue to be supported without losing critical services.

Appointing an executor is another vital function of a will. This person is responsible for carrying out your wishes, managing the estate, paying debts and taxes, and distributing assets. Choosing someone trustworthy, organized, and willing to serve is crucial. Without a named executor, the court appoints an administrator, who may not understand your family dynamics or financial priorities. This can lead to delays, missteps, and even conflicts of interest. By making this choice in advance, you ensure that your estate is handled by someone who respects your values and acts in the best interest of your beneficiaries.

Beyond legal appointments, a will communicates care and intention. It allows you to leave personal messages, explain difficult decisions, or express hopes for the future. These touches may seem small, but they can have a profound emotional impact on grieving family members. When people feel seen and understood, they are more likely to honor the plan and support one another through the transition. In this way, a will is not just a financial document—it is an act of love, ensuring that your presence continues to guide and protect those you leave behind.

Updating Your Plan: Life Changes, Money Changes

Life is dynamic, and so should be your financial plan. Major events such as marriage, divorce, the birth of a child, the death of a beneficiary, or the purchase of a home can significantly alter your financial landscape and personal priorities. Yet, many people create a will once and never revisit it, assuming it remains valid indefinitely. This complacency can lead to outdated provisions that no longer reflect current relationships or asset distributions. For example, a will that leaves everything to a former spouse—because it was never updated after a divorce—can cause legal complications and emotional pain for all involved.

Marriage often triggers the need for a review. While some states automatically revoke a will upon remarriage, others do not, meaning an old will could still be in effect. Newly married individuals should consider whether to include their spouse as a beneficiary, how to balance inheritance between children from previous relationships, and whether to establish joint trusts. Similarly, divorce requires immediate attention. Even if a court order modifies certain aspects of an estate plan, the will itself must be formally amended to remove ex-spouses from beneficiary designations and executor roles. Relying on assumptions or verbal agreements is risky—only written, legally executed changes provide certainty.

Changes in wealth also demand reassessment. If you’ve paid off your mortgage, started a business, or received an inheritance, your asset mix may have shifted significantly. A will that once seemed comprehensive might now overlook key holdings or undervalue certain accounts. Regular reviews—ideally every three to five years, or after any major life event—help ensure accuracy and relevance. During these reviews, it’s wise to gather updated account statements, property deeds, insurance policies, and any new legal documents to verify that everything aligns with your current situation.

Technology has made tracking and updating financial plans easier than ever. Digital estate planning tools, secure document storage, and family portals allow individuals to maintain organized records and share access with trusted advisors or family members. Some financial institutions even offer estate planning checklists and reminders for policy reviews. By integrating these resources into your routine, you reduce the burden on loved ones and increase the likelihood that your wishes are followed. The key is consistency: treating estate planning not as a one-time task but as an ongoing part of responsible money management.

Choosing the Right Tools: DIY vs. Professional Help

The rise of online legal services has made DIY wills more accessible and affordable than ever. For individuals with simple estates—modest assets, no dependents with special needs, and clear family dynamics—a well-designed template may suffice. These tools guide users through basic questions about beneficiaries, executors, and asset distribution, generating a legally valid document in minutes. The convenience and low cost are appealing, especially for those just starting to think about estate planning. However, the limitations of DIY solutions become apparent when circumstances grow more complex.

Generic forms often fail to account for state-specific laws, tax implications, or unique family situations. For example, a template may not include provisions for blended families, co-owned businesses, or international assets. It may also lack the language needed to establish trusts, handle digital assets, or address potential challenges to the will. In some cases, improperly worded clauses can render parts of the document invalid, creating confusion or opening the door to disputes. Once a will is challenged in court, the burden of proof falls on the estate, and unclear language can work against the testator’s intentions.

This is where professional guidance becomes invaluable. An experienced estate planning attorney brings expertise in local laws, tax codes, and legal precedents. They can help structure a will that not only reflects your wishes but also withstands scrutiny. They can advise on strategies to minimize taxes, protect vulnerable beneficiaries, and coordinate with other estate planning tools. Moreover, they provide personalized attention, asking questions you may not have considered—such as what happens if a primary beneficiary dies before you, or how to handle sentimental items that hold emotional but not monetary value.

The cost of hiring a professional varies, but it should be viewed as an investment rather than an expense. For many families, the fees associated with legal counsel are far less than the costs of probate delays, tax inefficiencies, or family litigation. In some cases, financial advisors or credit unions offer estate planning workshops or referrals to trusted attorneys as part of their member services. The decision to go DIY or seek professional help ultimately depends on the complexity of your situation, your comfort level with legal documents, and your long-term goals. When in doubt, consulting a professional—even for a single review—can provide clarity and confidence.

Making It Real: Practical Steps to Start Today

Starting your estate plan doesn’t require perfection—just progress. The most powerful step you can take is simply beginning. Begin by gathering a comprehensive list of your assets: bank accounts, investment portfolios, real estate, vehicles, insurance policies, and personal property of value. Next, identify the people who matter most—spouse, children, siblings, charitable organizations—and consider how you’d like your assets distributed among them. Think about who you would trust to serve as executor, guardian, or trustee. These decisions don’t need to be final right away, but writing them down creates a foundation for deeper planning.

Once you have a clear picture of your financial life, organize your important documents. Store them in a secure but accessible location—such as a fireproof safe or a digital vault—and inform a trusted person of their whereabouts. Make sure your beneficiaries on retirement accounts, life insurance, and payable-on-death bank accounts are up to date. These designations often override will instructions, so consistency is key. If you own property jointly, understand how ownership is structured—tenants in common versus joint tenants with rights of survivorship—as this affects how assets transfer upon death.

The next step is conversation. Talk to your family about your intentions, not to debate, but to inform and prepare them. These discussions can be difficult, but they prevent misunderstandings later. Let your children know who will manage their inheritance, explain why certain decisions were made, and express your hopes for their future. Share your plan with your executor and ensure they understand their role. Open communication builds trust and reduces the emotional burden on loved ones during a difficult time.

Finally, take action. If your situation is straightforward, explore reputable online platforms that offer guided will creation with attorney review options. If your estate is more complex, schedule a consultation with an estate planning attorney. Many offer initial meetings at no cost or for a nominal fee. Bring your asset list, family information, and questions. The goal is not to finish everything in one day, but to move forward with intention. Remember, a will is not a morbid document—it is a declaration of responsibility, care, and foresight. By creating one, you affirm that your life’s work matters, and you ensure that your financial legacy supports the people and values you hold dear.