How I Survived a Debt Crisis Without Breaking the Law—Tax-Smart Moves That Actually Worked

Debt creeps up quietly—until it’s choking your finances. I’ve been there: multiple payments, sleepless nights, and the panic of owing more than I earned. But the worst mistake? Trying quick fixes that risked my tax compliance. What saved me wasn’t magic—it was strategy. By aligning debt management with legal tax practices, I clawed my way back. This is how I turned chaos into control, without crossing any lines. The path wasn’t fast or easy, but it was safe, sustainable, and above all, lawful. In the midst of financial collapse, staying within the boundaries of tax law wasn’t just about avoiding penalties—it became the foundation of my recovery.

The Breaking Point: When Debt Overwhelms

Financial crisis rarely arrives with warning. For many, it begins subtly—a medical bill here, a car repair there, a missed workweek due to illness. These small disruptions accumulate, and suddenly, minimum payments feel impossible. The emotional toll is just as heavy as the financial strain. Anxiety becomes a constant companion, sleep is fractured, and decisions are made under pressure, often in desperation. It’s in these moments that people seek relief at any cost, sometimes turning to unregulated lenders, informal agreements, or even schemes that skirt legal and tax obligations. But crossing that line only deepens the crisis in the long run.

What many fail to recognize is that debt distress is often not the result of poor character or reckless spending. It can stem from sudden job loss, chronic health issues, or economic shifts beyond individual control. The key is not to assign blame but to respond with clarity and caution. Immediate relief is essential, but it must not come at the cost of future stability. This means resisting the temptation of shortcuts that promise quick fixes but carry hidden risks—especially those involving tax noncompliance. Whether it’s hiding income, falsifying records, or engaging in off-the-books settlements, these actions may seem like solutions in the moment but can lead to audits, penalties, and even legal consequences down the road.

Instead, the first step toward recovery should be an honest assessment of the situation. That includes not only listing all debts and creditors but also understanding how any resolution might affect tax obligations. For instance, negotiating a settlement with a credit card company may reduce what you owe, but the forgiven amount could be reported to the IRS as income. Without proper planning, a debt solution can inadvertently create a new tax liability—making the burden heavier, not lighter. Recognizing this connection early allows for smarter, more sustainable decisions.

The goal is not just to survive the crisis but to emerge with integrity intact. This means choosing paths that are not only effective but also transparent and compliant. It requires discipline, yes, but also access to accurate information and, when possible, professional guidance. The emotional weight of debt is real, but so is the power of a well-structured, legally sound recovery plan. By treating the crisis as a financial challenge rather than a moral failure, individuals can begin to rebuild—not just their balance sheets, but their confidence in managing money wisely.

Why Tax Compliance Matters More in a Crisis

When facing overwhelming debt, tax compliance might seem like a secondary concern—something to address later, once the immediate pressure has eased. But in reality, tax rules are deeply intertwined with debt resolution strategies, and ignoring them can turn a financial setback into a long-term disaster. The IRS treats certain debt relief actions as taxable events, meaning that money you didn’t physically receive could still be taxed. This creates what financial advisors often call “phantom income,” and it’s one of the most misunderstood and dangerous pitfalls in debt management.

Consider this scenario: a creditor agrees to forgive $15,000 of a $25,000 credit card balance. On the surface, this feels like a victory—$15,000 in relief. But if the creditor issues a Form 1099-C for the canceled debt, that $15,000 may be reported as ordinary income. For someone already struggling financially, this could push them into a higher tax bracket or create a tax bill they can’t afford. In some cases, the tax liability from forgiven debt can nearly offset the financial benefit of the settlement itself. This is why understanding the tax implications of debt relief isn’t optional—it’s essential.

Tax compliance during a debt crisis isn’t just about avoiding penalties; it’s about protecting your future. The IRS has the authority to place liens, levy bank accounts, and garnish wages. If you trigger a tax liability you can’t pay, you risk compounding your financial problems. Moreover, audits are more likely when there are discrepancies in income reporting, and a history of noncompliance—even if unintentional—can make future financial recovery more difficult. Lenders, landlords, and employers may also view tax issues as a red flag, affecting creditworthiness and opportunities.

Staying compliant doesn’t mean you have to accept every debt in full. There are legal and tax-efficient ways to restructure obligations, but they require careful planning. For example, the IRS recognizes certain exclusions from income for canceled debt, such as insolvency or bankruptcy. If you can demonstrate that your liabilities exceeded your assets at the time of cancellation, you may be able to exclude the forgiven amount from taxable income. However, this requires proper documentation and filing, not silence or avoidance. The lesson is clear: transparency and accuracy are not luxuries—they are tools of financial survival.

Asset Liquidity vs. Tax Traps: What to Sell and What to Keep

Selling assets to pay off debt is a common strategy, but it’s not without risk. Converting property, investments, or valuables into cash can provide immediate relief, but it may also trigger tax consequences that erode the benefit. The key is to evaluate each asset not just by its market value, but by its tax efficiency—how much of the proceeds you actually get to keep after taxes and reporting requirements.

Real estate is a prime example. If you own a second home or rental property, selling it might generate enough cash to eliminate high-interest debt. However, any profit from the sale—known as capital gain—could be subject to federal and possibly state capital gains taxes. The rate depends on how long you’ve held the property and your income level, but it can range from 0% to 20% or more, not including additional surtaxes. In contrast, the sale of a primary residence may qualify for an exclusion of up to $250,000 in gains for single filers or $500,000 for married couples, provided certain ownership and use tests are met. This makes the primary home a less risky asset to liquidate, assuming you meet the criteria.

Investment accounts present another layer of complexity. Selling stocks, bonds, or mutual funds at a profit generates capital gains, which must be reported. If the assets were held for less than a year, the gain is taxed as ordinary income, which could be significantly higher than long-term rates. Withdrawing from retirement accounts like a traditional IRA or 401(k) before age 59½ can be even costlier. Not only do you owe income tax on the withdrawal, but you may also face a 10% early withdrawal penalty. That means a $20,000 withdrawal could result in $5,000 or more in taxes and penalties, leaving you with far less than expected to pay down debt.

On the other hand, some assets carry minimal tax risk. Personal property like furniture, clothing, or vehicles typically doesn’t generate taxable gains when sold, especially if sold for less than original cost. While these items may not raise much cash, they don’t create new liabilities either. The strategic approach, then, is to prioritize selling low-tax-risk assets first and preserving those that could trigger significant tax bills. It’s also wise to consult a tax professional before any major sale—timing the transaction within a low-income year, for instance, could reduce or eliminate capital gains tax.

Negotiating Debt Without Triggering Tax Bombs

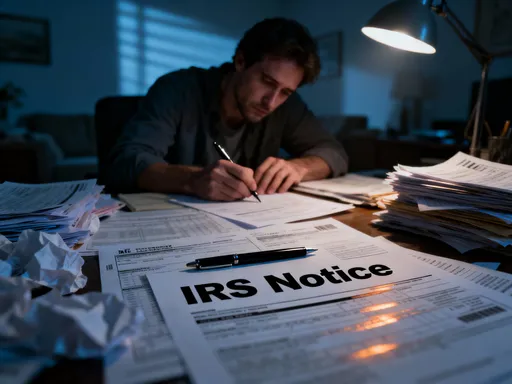

Debt settlement can be a lifeline for those drowning in unsecured debt. It involves negotiating with creditors to pay a lump sum that’s less than the full balance, with the remaining amount forgiven. While this reduces the total debt, it introduces a critical tax issue: the forgiven portion may be treated as taxable income. This is where many people stumble, unaware that relief can come with a tax price tag.

The IRS requires creditors to report debt cancellations of $600 or more using Form 1099-C. This form includes the amount of debt discharged, which the taxpayer must include in gross income unless an exclusion applies. For someone already in financial distress, receiving a 1099-C after a settlement can be a shock—especially if they used all their cash to make the payment and now face a new tax obligation. Without planning, this can lead to a cycle of new debt just to cover the tax bill.

Luckily, the tax code provides relief through exclusions. The most relevant for individuals in crisis is the insolvency exclusion. If your total liabilities exceed your total assets at the time the debt was canceled, you may exclude the forgiven amount from income. For example, if you owed $80,000 and had only $50,000 in assets, you were insolvent by $30,000. If $20,000 of debt was forgiven, the entire amount could likely be excluded because your insolvency cushion was larger than the forgiven debt. However, proving insolvency requires a detailed net worth statement—listing all assets and debts—and filing IRS Form 982 to claim the exclusion.

Another exclusion applies to debt discharged in a bankruptcy proceeding. In that case, canceled debt is not taxable at all. This makes bankruptcy not only a legal protection from creditors but also a tax shield in certain situations. However, bankruptcy has long-term credit implications and should be considered carefully. For those not filing bankruptcy, the insolvency exclusion is often the best path, but it requires documentation and accuracy. Guessing or skipping the paperwork can lead to IRS disputes, interest, and penalties.

The takeaway is clear: never accept a debt settlement without understanding the tax consequences. Always request a copy of the 1099-C from the creditor and review it for accuracy. If you qualify for an exclusion, file Form 982 with your tax return. Consulting a tax professional before finalizing any settlement can save thousands in unexpected taxes. Smart negotiation isn’t just about the dollar amount—it’s about preserving your tax position and avoiding future liabilities.

Restructuring Payments the Smart Way

Not every debt crisis requires asset sales or settlements. For many, the better path is restructuring—reshaping payment terms to make them manageable without triggering tax events. This approach focuses on sustainability rather than one-time fixes, allowing individuals to maintain cash flow while gradually reducing debt. Common strategies include debt management plans, consolidation loans, and direct renegotiation with creditors.

Debt management plans (DMPs), often offered through nonprofit credit counseling agencies, involve consolidating multiple unsecured debts into a single monthly payment. The agency negotiates with creditors to lower interest rates or waive fees, making repayment more affordable. Because no debt is forgiven, there’s no taxable event—no 1099-C, no phantom income. This makes DMPs a tax-safe option for those who can commit to a 3-5 year repayment schedule. The structured nature of these plans also helps rebuild financial discipline, which is often eroded during periods of crisis.

Debt consolidation loans work differently. They involve taking out a new loan to pay off existing debts, ideally at a lower interest rate. If secured by collateral—like a home equity loan—the interest may be tax-deductible, subject to IRS limits. For example, interest on home equity debt used to pay off credit cards may qualify as deductible if the total mortgage debt doesn’t exceed $750,000 and the funds are used for home improvements. However, if the loan is unsecured or used for general debt consolidation, the interest is typically not deductible. Still, the benefit lies in simplifying payments and reducing interest costs, not tax breaks.

Direct negotiation with creditors is another option, especially for those with a temporary hardship. Many lenders offer hardship programs that allow for reduced payments, deferred due dates, or temporary forbearance. These arrangements do not usually result in debt cancellation, so they don’t trigger tax liability. The key is to get any agreement in writing and confirm that no 1099-C will be issued. This protects the borrower from surprise tax bills and ensures the arrangement remains compliant.

The smartest restructuring strategies balance immediate relief with long-term tax efficiency. They avoid forgiven debt when possible, preserve credit where feasible, and maintain transparency with tax authorities. By focusing on consistent, manageable payments, individuals can regain control without creating new financial risks. The goal is not to erase debt overnight, but to build a path out of crisis that supports lasting stability.

Building a Compliance-First Mindset

Recovery from a debt crisis doesn’t end when the last payment is made. Lasting financial health requires a shift in mindset—one that prioritizes compliance, transparency, and long-term planning. This means treating tax obligations not as an afterthought, but as a core component of every financial decision, especially during times of hardship. A compliance-first approach isn’t about fear of punishment; it’s about building a foundation of trust—with the IRS, with lenders, and with oneself.

One of the most powerful habits is keeping accurate and organized financial records. This includes bank statements, debt agreements, correspondence with creditors, and any documentation related to settlements or restructurings. In the event of an audit or dispute, these records serve as proof of compliance. They also make tax filing smoother and reduce the risk of errors that could attract scrutiny. For those emerging from crisis, this level of organization may feel overwhelming at first, but it becomes easier with practice and routine.

Another key element is seeking professional advice early. A certified public accountant (CPA) or enrolled agent can help navigate complex tax rules, identify exclusions, and ensure filings are accurate. A credit counselor can assist with budgeting and debt management. These professionals don’t just provide expertise—they offer accountability and peace of mind. Their guidance can prevent costly mistakes and open doors to solutions that individuals might not discover on their own.

Avoiding off-the-books deals is also critical. While informal agreements with family or friends may seem harmless, they can create complications if not documented properly. Gifts, loans, and payments should be recorded, especially if they involve large sums. The IRS may question unexplained deposits or transfers, and without documentation, these can be misinterpreted as income. Clarity and transparency protect everyone involved.

Finally, a compliance-first mindset means accepting that financial recovery is a process, not an event. It requires patience, discipline, and a willingness to follow rules even when they feel inconvenient. But the rewards are real: a clean tax record, restored credit, and the confidence that comes from knowing you’ve rebuilt your finances the right way. This integrity becomes a source of strength, not just in personal finance, but in all areas of life.

From Survival to Stability: Rebuilding with Confidence

Emerging from a debt crisis is not the end—it’s the beginning of a new financial chapter. The journey from survival to stability involves more than paying off balances; it requires rebuilding credit, restoring savings, and redefining one’s relationship with money. The strategies that brought relief—tax-compliant debt management, careful asset decisions, and structured payments—now serve as the foundation for long-term resilience.

Credit repair starts with consistent, on-time payments and responsible credit use. Secured credit cards, credit-builder loans, and authorized user accounts can help reestablish a positive credit history. Monitoring credit reports regularly ensures accuracy and allows for quick dispute of errors. Over time, these steps lead to higher credit scores, which open doors to better interest rates, housing opportunities, and financial flexibility.

Saving, even in small amounts, restores a sense of security. An emergency fund—starting with $500 and growing to three to six months of expenses—acts as a buffer against future shocks. Automatic transfers to a savings account make this process effortless and consistent. This habit not only protects against future debt but reinforces the discipline developed during recovery.

Setting new financial goals provides direction and motivation. Whether it’s saving for a child’s education, planning a modest vacation, or preparing for retirement, having clear objectives helps maintain focus. Budgeting tools, apps, and financial plans make these goals tangible and achievable. Each milestone reached builds confidence and reinforces the value of compliant, thoughtful money management.

Perhaps most importantly, staying tax-compliant throughout the journey fosters trust—with institutions, with advisors, and within oneself. There is peace in knowing that your finances are not built on shortcuts or secrets, but on honesty and responsibility. This integrity becomes the true measure of financial health. The crisis may have been painful, but it also became a catalyst for growth. By choosing the lawful, sustainable path, you don’t just survive—you emerge stronger, wiser, and ready for whatever comes next.