What Your Nest Egg Isn’t Telling You: Market Moves That Matter

Saving for retirement feels like running on a treadmill—working hard but going nowhere. Many have been there, watching their pension fund grow slowly while daily expenses rise. The truth is, simply setting money aside is not enough to secure long-term financial stability. What truly shapes the future of your savings are the quiet but powerful movements of global financial markets. These shifts happen every day, often unseen, yet they determine whether your nest egg expands or erodes over time. Inflation, interest rates, stock performance, and economic cycles all play a role, even if you’re not actively trading. This article reveals how real-world market trends influence retirement outcomes and outlines practical, proven strategies to strengthen your financial foundation. You don’t need to become a trader or risk your security on speculative bets. Instead, understanding these forces—and making informed, disciplined choices—can help you build lasting resilience without fear or confusion.

The Hidden Force Behind Your Retirement Savings

Most people view their retirement savings as a safe, growing account that accumulates steadily over time. In reality, these funds are not static—they are constantly exposed to the movements of financial markets around the world. Behind every pension plan or individual retirement account lies a portfolio of investments, typically made up of stocks, bonds, real estate, and sometimes alternative assets. These holdings are carefully managed, often by professional fund managers, but their performance depends heavily on market conditions. When stock markets rise, retirement accounts often benefit. When bond yields fall or inflation surges, the same accounts may grow more slowly—or even lose value in real terms. This dynamic is what many savers overlook: their future income is not just a product of how much they save, but also of how those savings are invested and how markets behave over decades.

Consider the concept of asset allocation—the strategic division of investments among different types of assets to balance risk and return. A typical retirement fund might allocate 60% to stocks for growth and 40% to bonds for stability. But even funds labeled as “conservative” carry market exposure. For example, government bonds, often seen as safe, can lose value when interest rates rise. Similarly, stock holdings can fluctuate based on corporate earnings, geopolitical events, or shifts in consumer behavior. These changes may seem small month to month, but over 20 or 30 years, they compound into significant differences in final balances. A fund that earns 5% annually will double in value roughly every 14 years, while one earning only 3% will take over 23 years. That gap can mean the difference between a comfortable retirement and one filled with financial stress.

Understanding this hidden force means recognizing that retirement planning is not just about discipline in saving—it’s also about awareness of investment mechanics. Market movements are like weather patterns: you can’t control them, but you can prepare for them. Just as a farmer monitors rainfall and temperature, a saver should understand the financial environment shaping their nest egg. The good news is that you don’t need to predict every market turn. What matters more is having a strategy that accounts for volatility, adapts over time, and aligns with your long-term goals. By seeing your retirement fund not as a savings jar but as a living financial ecosystem, you gain the clarity needed to make smarter decisions.

Why “Set It and Forget It” Is a Trap

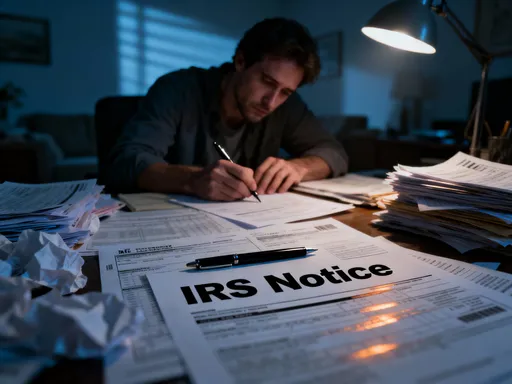

One of the most common misconceptions about retirement planning is that once you enroll in a pension plan or set up automatic contributions, your job is done. This “set it and forget it” mindset may feel reassuring, but it can lead to serious mismatches between your risk profile and your life stage. Retirement is not a single event—it spans decades, and your financial needs and tolerance for risk change along the way. A strategy that makes sense at age 35 may be dangerously inappropriate at 60. Without periodic review, many people discover too late that their portfolio is either too aggressive, exposing them to unnecessary losses, or too conservative, failing to keep pace with inflation and longevity.

Take the example of someone in their 40s who has built a portfolio heavily weighted in stocks. At that age, they have time to recover from market downturns, so a growth-oriented strategy is often appropriate. But if they never adjust their holdings as they approach retirement, they may still be exposed to high volatility just when they need stability. A sharp market correction in the five years before retirement can significantly reduce the value of their savings, forcing them to delay retirement or cut back on planned expenses. On the other hand, someone who shifts entirely to cash or low-yield bonds too early may protect against losses but sacrifice long-term growth. With people living into their 80s and 90s, retirement can last 30 years or more—meaning even “safe” investments must generate some return to avoid running out of money.

The solution is not constant monitoring or market timing, but regular, intentional review. Experts often recommend evaluating your retirement plan at least every three to five years, or after major life events such as a job change, marriage, or health issue. During these reviews, consider whether your current asset allocation still matches your time horizon and risk tolerance. Many employer-sponsored plans offer tools or access to financial advisors to help with this assessment. Some even include target-date funds, which automatically adjust the mix of stocks and bonds as you near retirement. While these can be helpful, they are not one-size-fits-all. Understanding the underlying strategy allows you to make informed choices rather than relying solely on default settings. Retirement security grows not from passive saving, but from active awareness.

Reading the Market Signals That Affect Long-Term Growth

Markets may seem unpredictable, but they are not random. They reflect real economic forces—supply and demand, corporate profits, employment trends, and government policy. Learning to read these signals doesn’t require a finance degree, but it does require attention to key indicators that shape long-term investment performance. Interest rates, inflation, and sector trends are among the most influential. When central banks raise or lower rates, it affects everything from bond yields to mortgage costs to company borrowing. Inflation, the steady rise in prices, quietly erodes purchasing power. If your savings grow at 3% but inflation is 4%, you’re losing ground in real terms. And sector performance—such as the rise of technology or the aging of populations boosting healthcare demand—can shift which investments thrive over time.

Consider interest rates. When rates are low, bonds pay less, pushing investors toward stocks in search of returns. This can drive stock prices higher. But when rates rise, bonds become more attractive, and stocks may fall as borrowing costs increase for companies. This relationship affects retirement funds even if you don’t own individual stocks. Similarly, inflation impacts both your future expenses and the real value of your savings. Historically, stocks have been one of the best hedges against inflation because companies can raise prices and profits over time. Bonds, especially fixed-rate ones, tend to lose value when inflation rises. This is why a balanced portfolio matters—it spreads exposure across assets that respond differently to economic changes.

Sector trends also reveal long-term shifts. For instance, the global population is aging, increasing demand for healthcare, pharmaceuticals, and senior services. Technology continues to disrupt traditional industries, from retail to transportation. Renewable energy is gaining ground as climate concerns grow. These trends don’t guarantee profits, but they help explain where capital is flowing and why certain funds outperform others. You don’t need to pick individual winners, but understanding these dynamics allows you to evaluate whether your fund manager is positioning your money wisely. Are they investing in growing industries? Are they adjusting for economic cycles? These are the questions that matter for long-term growth.

Balancing Risk Without Sacrificing Returns

Many people believe they must choose between safety and growth: either protect their money in low-risk accounts or chase higher returns with volatile investments. But effective retirement planning isn’t about extremes—it’s about finding risk efficiency. This means achieving the best possible return for the level of risk you can comfortably handle. The key tool for this balance is diversification, but not just in the generic sense of “don’t put all your eggs in one basket.” True diversification involves spreading investments across asset classes, geographic regions, and sectors in a way that reduces overall volatility without sacrificing long-term gains.

For example, a portfolio that includes both U.S. and international stocks may perform more steadily than one focused only on a single market. When the American economy slows, another region might be growing. Similarly, combining stocks, bonds, and real estate can smooth out returns because these assets often move differently in response to economic conditions. Rebalancing—periodically adjusting your portfolio back to its original allocation—also plays a crucial role. Over time, some investments grow faster than others, shifting your risk profile. Selling some of the winners and buying more of the underperformers maintains your intended balance and can enhance returns through a “buy low, sell high” mechanism, even if done mechanically.

Studies have shown that for most long-term investors, a well-diversified portfolio with regular rebalancing can reduce drawdowns during market downturns by 20% or more, while still capturing the majority of market gains over time. This doesn’t eliminate risk, but it makes it more manageable. The goal is not to avoid all losses—that’s impossible in any market-based system—but to avoid catastrophic ones. By focusing on risk efficiency, you protect your savings from extreme swings while staying on track for growth. This approach supports peace of mind, knowing your strategy is built for the long haul, not short-term noise.

The Psychology of Long-Term Investing (And How to Beat It)

Even the best financial plan can fail when emotions take over. Fear and greed are powerful forces, and they often lead people to make decisions that hurt their retirement goals. During market downturns, panic can drive investors to sell at the worst possible time, locking in losses. In bull markets, excitement may lead them to chase high-flying stocks or sectors that have already peaked. These behavioral mistakes are common and understandable, but they can derail decades of disciplined saving. The challenge isn’t just knowing what to do—it’s doing it consistently, even when emotions scream otherwise.

Behavioral finance research shows that investors often underperform the market not because of poor strategy, but because of poor timing. One study found that the average investor earned significantly less than the stock market’s long-term return, largely due to buying high and selling low. This happens because people respond to recent performance rather than long-term trends. When headlines scream about crashes, it’s hard to stay calm. When a tech stock soars, it’s tempting to jump in. But disciplined investing means ignoring the noise and sticking to a plan.

Fortunately, there are tools to help. Automatic contributions remove the need to decide when to invest—money flows into your account each month, regardless of market conditions. This creates a habit of consistent saving and naturally leads to dollar-cost averaging, where you buy more shares when prices are low and fewer when they’re high. Target-date funds automate asset allocation, gradually shifting to safer investments as retirement nears. Decision rules—such as “I will not sell during a downturn unless my financial needs change”—can also help you stay on track. The goal is not to eliminate emotions, but to design a system that reduces their impact. Over time, discipline becomes more powerful than instinct.

Practical Moves Anyone Can Make—No Finance Degree Needed

You don’t need to be a financial expert to improve your retirement outlook. Simple, low-effort actions can have a meaningful impact. Start by reviewing your fund’s factsheet—a document most providers offer online. It shows your portfolio’s asset allocation, fees, and historical performance. Look at the expense ratio, which tells you how much you’re paying in annual fees. A difference of even 0.5% can cost tens of thousands over a lifetime. If your current plan charges high fees or offers limited investment choices, consider whether switching providers is an option. Many platforms now offer low-cost index funds with broad diversification and transparent pricing.

Next, assess your contribution split. Are you putting enough into tax-advantaged accounts like 401(k)s or IRAs? If your employer offers a match, make sure you’re contributing at least enough to get the full benefit—it’s essentially free money. You might also adjust how your contributions are allocated among funds. For example, increasing exposure to international stocks or real estate can enhance diversification without complexity. Updating beneficiaries is another simple but important step—life changes, and your plan should reflect your current wishes.

Finally, use free tools to gain insight. Many financial websites offer retirement calculators that project your savings based on current contributions, expected returns, and retirement age. These aren’t perfect, but they provide a reality check. If the numbers fall short, you can adjust now—by saving a little more, working a few more years, or planning for a more modest lifestyle. The power of small changes compounds over time. The key is to take action, not wait. Every step you take today strengthens your future.

Building a Future That Lasts—Beyond the Numbers

Retirement is not just about financial security—it’s about freedom, dignity, and the ability to live on your own terms. The choices you make today shape not only your bank balance but also your quality of life decades from now. Will you be able to travel, support family, pursue hobbies, or leave a legacy? These goals are deeply personal, but they all depend on sound financial planning. By understanding how markets work, avoiding emotional traps, and making consistent, informed decisions, you build more than wealth—you build confidence.

The journey doesn’t require perfect timing or extraordinary returns. It requires patience, awareness, and a willingness to engage with your finances in a thoughtful way. Start where you are. Review your plan. Adjust what you can. Stay the course. Over time, small, smart choices accumulate into lasting results. Your nest egg may not speak, but it carries a story—one shaped by your actions, your discipline, and your vision for the future. Make it a story of resilience, clarity, and peace of mind.